Brand Led Growth project | Pocketly.in

Section I: Crafting the core value prop

Step 1: Understand the product

What is the product really in the business of?

Pocketly offers instant personal loans to tech savvy young Indians who are either salaried or self-employed through a quick, paperless process. The core benefit is fast disbursal of funds ranging from ₹500 to ₹50,000, providing immediate access to cash with flexible repayment options at competitive interest rates. It caters to youngsters who find traditional loan processes cumbersome!

What problem does the product solve?

Pocketly solves the following key problems for young, tech savvy Indians needing quick small loans:

- Lengthy Application Processes (I hate long loan application processes)

- Slow Traditional Loan Disbursals (Waiting for cash is so frustrating)

- Low Credit Access for young professionals (Without credit history, getting loan is really tough)

- Inflexible Repayment Options & High-Interest Rates (I need flexible repayment & loan options)

- Lack of Access to Emergency Funds (I need quick funds without long paperwork or queues)

Core customer benefits of Pocketly for young Indians include:

- Instant Loan Approval with Super Fast Disbursal

- Accessibility Even to Self-employed Individuals

- Flexible Repayment Options

- Competitive Interest Rates compared to traditional sources like credit card loans

How is your user currently solving the problem?

In India, tech savvy individuals earning a basic income with Aadhaar and PAN cards can access instant credit through several means:

- Pre-approved Personal Loans: Offered by banks and NBFCs with minimal documentation

- Credit Card EMIs: Convert purchases into EMIs for easier repayment

- Buy Now, Pay Later (BNPL): Services like Simpl, LazyPay

- Digital Lending Platforms: Apps like KreditBee, MoneyTap, and EarlySalary

- "While platforms like KreditBee, MoneyTap, and EarlySalary also provide quick loans, Pocketly focuses on ultra-short loan tenures (1-4 months) and flexible repayment options, catering particularly to urgent financial needs and providing a user-friendly experience

- Peer-to-Peer Lending: Platforms like Faircent and LenDenClub

- Unlike Peer-to-Peer lending platforms which match borrowers with individual lenders and may involve longer approval times, Pocketly provides immediate funds directly through its app. No intermediary, faster access to cash

STEP 2: Define Job to Be Done of the Brand

Therefore, Pocketly is a new product in an existing category of personal loan apps. With huge inbound interest for such platforms, the jobs to be done for a brand like Pocketly are to solve for:

- distinctiveness

- preference

- trust

STEP 3: Understanding the User (ICPs)

ICP 1: Young Salaried Professional

Name: Megha

Age: 23

Location: Mumbai

Values: Convenience and speed, Financial independence, Reliability

Negotiables: Slightly higher interest for instant access

Non-Negotiables: Immediate fund availability, Easy application process

Aspirations: Building a credit history, Funding immediate needs (courses, certifications)

Goals: Accessing emergency funds without hassle, Managing small, unexpected expenses seamlessly, Avoiding traditional loan complexities"

ICP 2: Self-Employed Freelancer

Name: Rohan

Age: 25

Location: Indore

Values: Flexibility and control, Quick financial solutions, Low bureaucracy

Negotiables: Minor fees for quicker processing

Non-Negotiables: No lengthy documentation, Flexible repayment terms

Aspirations: Maintaining financial stability between projects, Growing their freelance business

Goals: Securing quick funds for immediate needs, Bridging gaps between project payments, Simplifying financial management"

ICP 3: Young Entrepreneur

Name: Shlok

Age: 28

Location: Bengaluru

Values: Innovation and agility, Quick decision-making, Trustworthiness

Negotiables: Access only to smaller amounts

Non-Negotiables: Immediate loan disbursal, No hidden fees on account of low creditworthiness

Aspirations: Seizing new business opportunities, Managing cash flow efficiently

Goals: Accessing funds for business emergencies or opportunities, Avoiding delays that could affect business operations, Maintaining financial liquidity"

Step 4: Articulating the Core Value Prop

For [tech savvy young Indians]

who [need quick & small loans],

Pocketly is [a digital lending platform] that offers

[immediate short term credit with less paperwork and more repayment flexibility]

Section II : Find the brand wedge

Step 1: Answer 5 core questions

What are some category insights? What are the top problems the category is suffering from?

- Cumbersome Processes: Traditional lending is lengthy and has extensive paperwork

- Slow Disbursal: Delay in loan approval and disbursal is a significant pain point

- Lack of Transparency: Hidden fees and unclear terms create mistrust among users

What are your user problems? What are the top problems the user faces?

- Urgent Financial Needs but Low CIBIL: Users need quick access to small amounts, but may not have necessary CIBIL scores to get loans from banks

- Application elsewhere is complex & time consuming

- Repayment options are rigid, causing stress to young, early career professionals, freelancers!

What are your user non-negotiables?

- Transparency: Clear and upfront communication about loan terms, fees, and conditions

- Speed: Fast approval and disbursal of loans, preferably within minutes

- Simplicity: An easy process with minimal documentation is preferred

What are the user negotiables?

- Interest Rates: Users might tolerate slightly higher interest rates if the process is faster

- Loan Amounts: Users are flexible with the exact amount permitted for borrowing

What are their aspirations?

- Manage their financial needs with quick credit

- Find a trustworthy lender who understand their needs & won't create trouble

- Convenience in application process and Flexibility in repayment

Step 2: Define your brand wedge

If category perception is that [lending process is cumbersome and slow] & users feel [frustrated by lengthy applications and delayed disbursal], then Pocketly will always solve for it by providing [access to immediate, small loans with minimal documentation for salaried or self employed people]

Step 3: How will the brand look?

I am modern and sleek, but I am not complicated.

Translation to Design Elements:

- Logos: Minimalist design, clean lines, contemporary fonts

- Type: Sans-serif fonts that are easy to read and modern

- Illustrations: Simple, relatable, and friendly graphics

- Iconography: Intuitive icons that guide the user effortlessly

Step 4: How will the brand speak?

I am approachable and clear, but I am not overly casual.

- VOICE: Friendly, supportive, and informative

- TONE: Positive, and reassuring

- WRITING STYLE: Clear, direct, and engaging

Step 5: How will the brand behave?

I am responsive and dependable, but I am not intrusive.

Pocketly's brand footprint is designed to resonate with young Indians seeking quick, small loans by ensuring the

- brand looks modern and sleek

- speaks in an approachable and clear manner

- and behaves in a responsive and reliable way

This approach builds distinctiveness, preference, and trust among the target audience.

Impact of Suggested Behaviour:

- Distinctiveness: Being highly responsive and reliable, Pocketly stands out from traditional lending platforms.

- Preference: User-friendly policies and a supportive approach create a preference for Pocketly over competitors.

- Trust: Consistent and transparent interactions throughout the lending journey build long-term trust with users.

Section III: Apply brand on & off the product

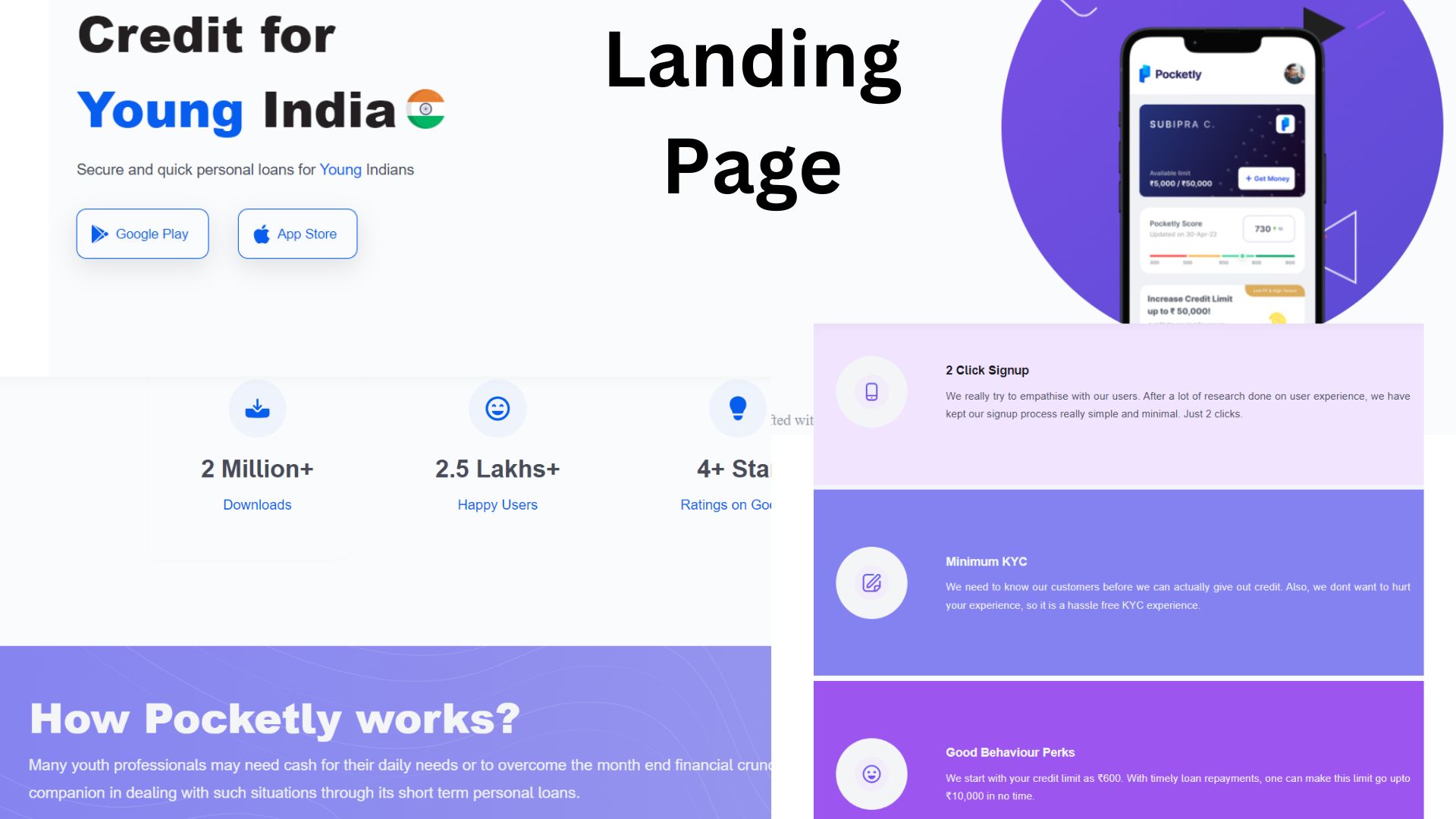

Step 1: Screenshots

From the screenshots, it is evident that while Pocketly is mostly responsive and reliable, it can improve on clarity in policies and friendliness in communication. Moreover, it must behave less intrusively. This will help build distinctiveness, preference, and trust among users.

Step 2: Apply the brand footprint to the visual design across every single touchpoint.

I am modern and sleek, but I am not complicated.

Recommended Design Elements:

- Logos: Minimalist design, clean lines, contemporary fonts.

- Type: Sans-serif fonts that are easy to read and modern.

- Illustrations: Simple, relatable, and friendly graphics.

- Iconography: Intuitive icons that guide the user effortlessly.

Current Design Elements:

- Minimalist & youthful

- Modern sans-serif fonts

- Flat design i.e. minimalist 2D elements with simple shapes in limited colours

- Overall, a modern & clean look that is user-friendly

Changes Suggested

The brand is mostly modern & sleek. But, to better evoke energy & youthful appeal, more vibrant colours like orange could be incorporated. Moreover, consistency is required across designs, which can be enforced by a detailed brand guideline doc.

Step 3: Apply the brand footprint to changing copy across every single touchpoint.

I am approachable and clear, but I am not overly casual.

Recommended Brand Copy

- VOICE: Friendly, supportive, and informative

- TONE: Positive, reassuring, and straightforward

- WRITING STYLE:

- What you say (Voice):

- "Get your funds in a jiffy!"

- "We've got your back!"

- "Flexible loans for your immediate needs."

- How you say it (Tone):

- "Need quick cash? Pocketly makes it easy and fast!"

- "Don’t stress over emergencies, we’ve got you covered."

Overall Writing Style:

- Short sentences

- easy-to-understand language

- avoiding jargon

- focusing on benefits

Current Brand Copy

- VOICE: Friendly and supportive, but slightly formal

- TONE: Reassuring and informative, but not consistently positive

- WRITING STYLE:

- Voice: Copy is clear and direct but could be more engaging

- Tone: Informative but can be more upbeat

- Overall Writing Style:

- Short & clear sentences used

- but tone could be more positive & less formal

Changes Suggested

Voice

Current: Get an instant personal loan in just a few clicks.

Suggested: Get funds to meet your needs in a jiffy! Pocketly is here to help.

Tone

Current: Apply now and solve your financial needs quickly.

Suggested: Need quick cash? Pocketly makes it easy and fast!

Writing Style

Current: Flexible repayment options to suit your needs.

Suggested: Choose how you wish to repay! We're here to help.

OR - Don’t stress over emergencies, we’ve got you covered.

Step 4: Apply the brand footprint to how the brand behaves with its users.

I am responsive and dependable, but I am not intrusive.

Recommended User Policies and Journeys:

Pre-loan :

- Clear and transparent communication: Policies are explained in simple terms, ensuring users understand loan terms and conditions.

- Seamless application process: Fast approval process with minimal documentation to reduce friction.

- Educational resources: Providing financial tips and guidance to help users make informed decisions.

During loan :

- Regular updates: Users receive timely notifications about their loan status, repayment schedules, and any changes in terms.

- User-friendly interface: An intuitive app experience that allows users to manage their loans effortlessly.

- Proactive support: Customer service is readily available to address any issues or concerns promptly.

Post-loan :

- Feedback loops: Encouraging user feedback to continuously improve the service.

- Loyalty rewards: Offering incentives for timely repayments and repeat users.

- Refinancing options: Providing flexible refinancing options to accommodate users' changing financial situations.

Current User Policies

and Problems:

Pre-Loan :

- Terms & Conditions Review: The terms are detailed but might be overwhelming for users.

- Playstore Reviews: Users appreciate the speed but mention issues with understanding terms.

Suggested Changes

- Simplify language for better clarity

- Highlight key terms prominently.

- Example: Instead of “Borrower covenants,” can use “Your committment to us.”

During Loan :

- Grievance Redressal Policy Review: Comprehensive but formal.

- User Interface and Support: Functional but could be more intuitive.

Suggested Changes

T&C Change Suggested : Regular updates on the loan status with clear instructions

- Example: “You’ll get reminders 3 days before your payment is due.”

Grievance Redressal Change Suggested : Make the complaint process simpler & faster

- Example: “Report any issues directly through our app for quick assistance.”

UI/UX Change Suggested: Make the interface easier to navigate, add a walk through.

- Example: “Track your loan status easily on this dashboard.”

Post-Loan :

- Playstore Reviews: Users mention lack of follow-up after loan closure.

- Terms & Conditions Review: Lacks emphasis on post-loan benefits.

Suggested Changes

User engagement: Implement loan closure feedback, offer loyalty rewards for timely payments.

- Example: “Thank you for your prompt payments. Here’s a reward!”

Promotions: Clearly promote benefits like increase in credit limits on loan closure

- Example: “Pay up on time to access bigger & faster loans in the future”

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.